This post was written by Hyke. Hyke is an all-in-one business administration platform for the top freelancers. From LLC formation to taxes, Hyke takes away all the pain with paperwork and helps you stay safe, compliant and save on taxes.

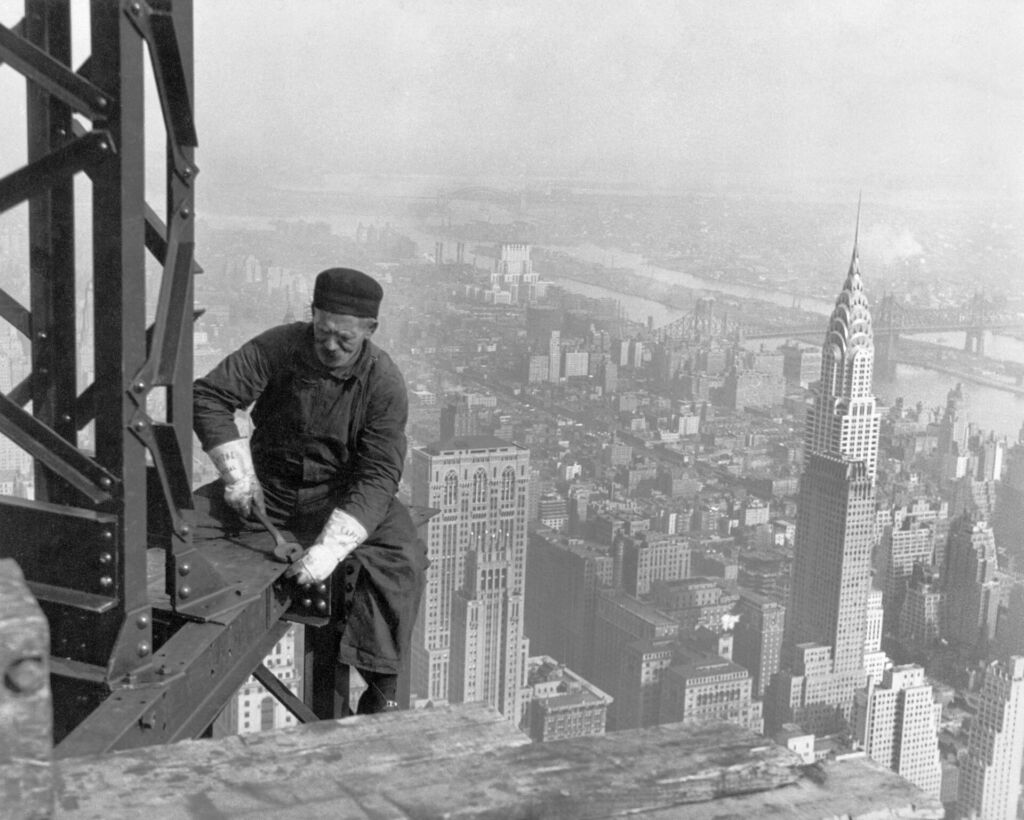

Running a freelance business could be a great way to earn a living, and it can also be extremely satisfying and fulfilling. For many, there’s no better way to work, as you get to be your own boss and do what you enjoy most without being controlled by an employer.

The sky’s the limit when you freelance, but you should be aware that there are some risks involved. In fact, working for yourself is riskier than simply being someone else’s employee.

To understand the risks that you’re taking on when you become a freelancer, we’ve outlined a few of the main ones below, along with some advice on what you can do to reduce those risks so that you can continue working for yourself.

1. Losing Money

When you’re working as an employee, as long as you have your job, you must be paid. Even if your employer’s business is slow, they’re required to pay you. When you’re a freelancer, though, you don’t have this guarantee of payment. If you aren’t generating business, you don’t make money. And, once your expenses begin exceeding your income, you’ll start losing money. Pretty frightening, indeed! In fact, this risk alone is enough to scare many people away from freelancing.

Bottom line: when you run a business for yourself, it’s up to you to find work and keep it coming in. Otherwise, you won’t have money to pay bills or buy groceries. The assurance that comes with punching a time clock simply isn’t there.

But let’s look at the flipside, shall we? Most freelancers don’t mind taking on this risk because it means that they can bask in the freedom that comes with doing business for themselves. When you freelance, you get to make all of the final decisions, from where and when you work, to how many hours you’ll put in and what clients you’ll work with. For these reasons, a lot of freelancers actually start to enjoy working—there are a lot of people out there who can’t even imagine what that’s like!

Plus, if business is good, you even have the potential to make more money as a freelancer than you would if you were working as an employee doing the same type of work. Take, as an example, someone who works as an employee in a public relations firm. That firm might bill the clients you do work for $150 per hour, but you might only make $30 per hour. As a freelancer doing the same work for the same types of clients, you could charge $100 per hour and earn a higher income. Nice, right?

Here are some ways to reduce the risk of losing money as a freelancer:

- How much you’re paid is a matter of negotiation with your clients. Consider enhancing your negotiation skills, but also focus on continually improving your own skill set so you’ll be in greater demand and be able to earn more. The more in-demand your skills are, the greater the earning potential you’ll have.

- Write up a business plan that outlines your goals for the next three to five years, including financial projections. Not sure how to write a business plan? Have no fear, as you can use the online Business Plan Tool (it’s free!) from the Small Business Administration.

- Prior to starting your freelance career, have enough money saved, or have other financial resources (such as your spouse’s income), to last long enough to support you as you build a business and make it profitable.

2. Lawsuits

Let’s face it, we live in a lawsuit-happy age. And the sad truth is that, when you’re working as a freelancer, there are quite a few ways that you could end up getting sued. Yikes!

Malpractice liability – These lawsuits allege negligence by professionals like lawyers, doctors, dentists, and others

Contract liability – These lawsuits allege breach of business contracts. For example, if your client feels that your work wasn’t up to par, they can sue you for not living up to the standards outlined in your contract.

Premises liability – These lawsuits claim that you’re responsible for damages or injuries that occurred at your place of business

Infringement liability – These lawsuits occur when someone claims that you’ve infringed on a patent, copyright, trademark, or trade secret

Employer liability – These lawsuits claim that you’re liable for injuries or damages caused by an employee while they were working for you

Payroll tax liability – These lawsuits claim that the person in charge of your payroll failed to properly withhold and pay income tax and Social Security tax for your employees

Product liability – These lawsuits claim that you’re responsible for injuries or damages caused by a product that you manufactured and sold to the public

Negligence liability – These lawsuits claim that you caused damages or injuries because you failed to use “reasonable care” in your actions

When you’re sued, your business assets are on the line. This means that losses from the lawsuit can be collected from your business bank account or other business assets. If you are held personally liable for lawsuits against your business related activities, you will be required to pay the judgement yourself. The latter is rare, but because many freelancers – especially early on in their careers – don’t have a clear separation between their business and personal assets, this can get sticky quickly. A good first step as a freelancer is to make clear distinctions between your business and personal assets so you aren’t vulnerable to losing your personal assets like savings, personal property, or even your house.

Luckily, there are some easy ways for freelancers to reduce the risk of lawsuits resulting in losses.

Reducing Your Risk of Personal Liability

- Start by forming a legal entity for your freelance business, rather than working as a sole proprietor. Why? Well, as a sole proprietor, you’ll personally own the business, so you’ll be personally liable for damages and injuries. For purposes of protecting your personal assets, the two most popular entities are the limited liability company (LLC) and the corporation.

The simple act of forming an LLC or corporation can also be effective when it comes to protecting yourself from being held personally liable for wrongdoing by others (co-owners, subcontractors, or employees, for example). - Keep in mind that, even if you form an LLC or corporation, you’ll still be personally liable for any of your own personal actions that harm others. For example, if someone slips and falls at your place of business, and claim you neglected to keep your premises safe, you could be sued. Another common concern for freelancers in creative and tech fields is copyright infringement. If someone claims that you’ve infringed on a copyright or patent, you could be held personally liable for that as well.

Protecting Against Lawsuits:

To protect yourself against these types of lawsuits, it’s best to obtain liability insurance. In doing so, your insurer will be able to defend you in a lawsuit, as well as pay settlements or damage awards up to your policy limits. Wise business owners insure their businesses year round, even (and perhaps especially) if that business is themselves. The good news is that this type of coverage typically isn’t all that expensive for freelancers. A hundred to a few hundred dollars per year could give you loads of peace of mind and protection, and you might even be able to deduct your insurance premiums as a business expense. Sweet!

Get a quote online, starting at $21/Month

3. Debt

When a business incurs debt from business expenses, a business creditor can go after its assets. When a person goes into debt from personal expenses, a personal creditor can go after their personal assets. Again, as a sole proprietor, these assets are largely one and the same. That means a business creditor or a personal creditor can go after all of your assets, including personal and business assets. Note: a business creditor is a person or company to whom you owe money for items that you’ve purchased for use in your business, while a personal creditor is someone to whom you owe money for the purchase of personal items.

Reducing Your Risk of Debt

- Once again, forming an LLC or a corporation may be a smart move. Either of these entities will provide you with “limited liability,” meaning you can lose what you’ve invested in your business, but creditors can’t go after personal assets like your home.

- It’s important to know that the limited liability that a small business owner can get by forming an LLC or corporation has its faults. Many creditors aren’t likely to let you shield your personal assets by forming an LLC or corporation; instead, they’ll likely require that you personally guarantee business loans, credit cards, and extensions of credit, so you’ll still be personally liable for that debt. Other lenders may require personal guarantees of payment for expenses like office or equipment leases as well.

- However, the good news is that you can avoid having to make personal guarantees for purchases that are most common to freelancers, like small equipment, technology, and office supplies.

- In the event that your business debts do get out of control, you always have the option of filing for bankruptcy.

4. Not Being Paid

When you’re working for an employer, they pay you like clockwork. They likely have a payroll system in place for their employers, and because they depend on your continued efforts, they aim to keep their workforce as content as possible.

Freelancers are often not paid with the same urgency. Unfortunately, businesses may have neither the incentive nor the systems to pay their freelancers quickly and efficiently. To them, once the work is completed, compensation is not seen as a priority.

As a freelancer, it may be up to you to be persistent with your clients until they pay you for your services. Of course not all companies are out to take advantage of freelancers, but it’s often impossible to spot one until you’re staring at a stagnant bank statement.

Helpful strategies to get paid for the work you’ve completed

- Always have written agreements in place before getting started. Clearly state how much you’ll be paid for the work you complete, as well as when you’ll be paid.

- Consider asking clients for a down payment prior to beginning your work. You might ask for 1/3 or ½ of the total payment upfront, with the remainder to be paid upon completion of the project.

- If a project is going to last longer than a couple of months, use payment schedules. These will require that the client pays in stages. And if the client fails to make a payment, you can stop work—and cut your losses.

- Check out your prospective client’s credit prior to accepting work from them.

- Always promptly invoice your clients after you’ve completed work for them.

- If payments are overdue, charge a late fee.

- Consider working through freelance platforms which serve as an intermediary between you and the client. They not only help you find consistent work, but they often take care of ensuring prompt payment as well.

- Professional Liability Insurance can help you cover lost wages, or legal action aimed at getting the compensation you’ve earned.

5. Illness or Disability

A well known advantage to being employed are salaried benefits like health insurance and paid sick leave. Employers also generally provide workers’ compensation which allows employees to collect benefits if they’re injured on the job, even if the injury is their own fault.

As a freelancer, you forgo these benefits. Unfortunately, when it comes to paying for health insurance, you might be hit with higher rates than an employer would pay for the same coverage. And if a work-related injury is your fault, a staffing firm won’t be responsible because they don’t provide workers’ compensation coverage to independent contractors. (Read Buying Guide: Health Insurance for the Self-Employed for tips on building your own safety net)

Some on demand marketplaces have begun to offer Occupational Accident Insurance, the gig economy replacement for Workers’ Comp, but this is still largely relegated to manual labor positions. Additionally, if you end up taking time off because of your injuries – or just because you’re sick – you’ll end up cutting your bottom line.

Protecting Yourself Against Health Related Losses

- If your spouse receives health insurance at work, you might be able to receive coverage for yourself as well. Easy enough!

- If you need to get health insurance for yourself, check out your state’s health insurance exchange. Remember: even if you have a preexisting condition, the law requires that you be eligible for coverage.

- If the health insurance plans available are too expensive, see if you qualify for a tax credit that can help cover the cost of premiums. As of this writing, married couples without kids can earn no more than $65,000 annually to qualify for this support, while single individuals can’t earn more than $48,000 annually to qualify. You can visit Healthcare.gov to get up-to-date information.

- Check out our recent post, Freelance Insurance 101: Health Insurance for an in-depth look at your coverage options.

Note: As of 2018, the Affordable Care Act still requires that everyone, including self-employed freelancers, have minimally adequate health insurance. If you don’t have coverage, you’ll pay a fine to the IRS. This may change in 2019, but getting health insurance is still recommended, as it can provide immense support if you’re hurt or diagnosed with an illness—and that could help protect your business as well.

Reduce Your Risks with the Help of Hyke!

Yet another way to reduce the risks of doing business as a freelancer is by opting to use services like Hyke. After signing up for an account, you’ll receive expert guidance so that you can legally form your business in your state. Then, Hyke will take all of the guesswork out of other aspects of launching a successful business, including getting your EIN, obtaining the right licenses, opening a bank account, filing the right paperwork, and more.

After your freelance business is up and running, Hyke will still be there for you with a handy dashboard that you can use daily to track income and expenses, as well as file taxes and other necessary forms on time. At any time, you can read through handy resources to learn even more about the ins and outs of maintaining a lucrative venture on your own.

Weigh the Pros and Cons of Freelancing

There’s quite a bit to consider before diving into the world of freelancing. Many people find that the pros outweigh the cons, especially since there are so many ways to mitigate the risks of doing business.

Once you get the hang of working as a freelancer, you’ll undoubtedly enjoy the freedom of doing what’s most fulfilling to you. And with the tips and strategies above, you can be more aware of your risks, as well as take steps to avoid those risks. So here’s to forging your own path while earning an income that lets you live your best life!

If your interested in learning more visit https://buildbunker.com/ or contact us at support@buildbunker.com

Protect Your Business for $21/Month

We’ve made business insurance easy and affordable for freelancers like you. Get a quote in as little as 5 minutes, and purchase online. Real advisors will be available via phone & live chat to help you every step of the way!

Suggested for You:

A Brief History of the Independent Contractor Classification

A Brief History of the Independent Contractor Classification